Many factors influence the volume of dwellings in the pipeline and the progress of dwellings from strategic planning to occupancy. The NSW Government is actively monitoring the housing supply pipeline in NSW across 5 stages: strategic planning, zoning, infrastructure servicing, development approval and construction and completion. In addition, four targets are used to monitor quarterly progress.

| NSW housing targets 2022 | ||

|---|---|---|

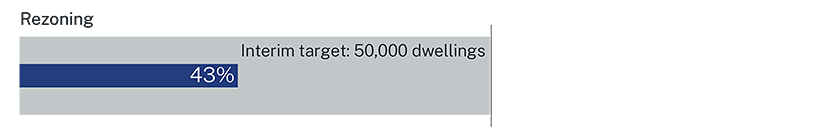

| Zoning | 100,000 dwellings unlocked by 2023–24 (including 70,000 dwellings from state-led rezoning approvals and 30,000 dwellings from council-led rezoning approvals) | Interim target: 50,000 dwellings by June 2023 |

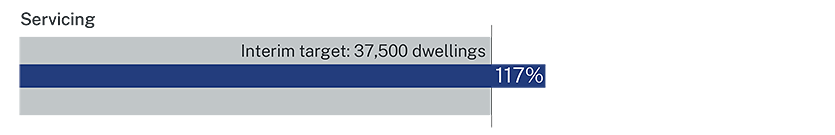

| Infrastructure servicing | 150,000 dwellings supported by housing-focussed infrastructure programs by 2025–26 | Interim target: 37,500 dwellings supported by June 2023 |

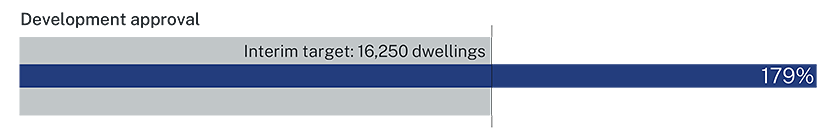

| Development approval | 32,500 dwellings unlocked by 2023–24 (from state-significant and regionally significant development approvals) | Interim target: 16,250 dwellings by June 2023 |

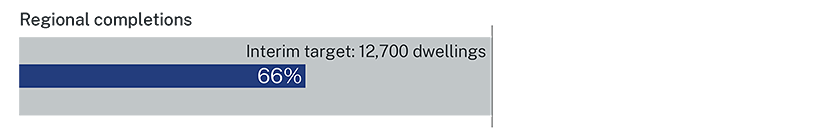

| Housing supply in regional NSW | 127,000 dwellings delivered in regional NSW by 2031–32 | Interim target: 12,700 dwellings by June 2023 |

Stage 1: Strategic planning

Local Housing Strategies

The department is working closely with Greater Sydney councils to help them reach local housing supply targets through implementation of the local housing strategies.

All Greater Sydney councils have a local housing strategy (LHS) in place. By 31 March, 32 out of 33 councils in Greater Sydney have submitted Implementation and Delivery Plans (IDP), or equivalent strategic works program, to implement their local housing strategies. One remaining council (Ku-ring-gai) has indicated it will not be submitting an IDP.

The IDPs outline investigations, studies, planning proposals and consultation required to deliver the local housing strategies and a budget and schedule for their delivery. The plans provide a clear roadmap for housing supply for Greater Sydney councils. Many regional councils are also reviewing their local housing strategies using the same approach to support a sustainable supply pipeline over the long term.

During the March quarter, the department engaged with councils on LHS implementation. These sessions provided useful insights into the challenges confronting councils in meeting housing targets, resourcing and funding strategic works programs and reporting on LHS implementation. The department is currently exploring how it might assist councils with these matters and will engage again with councils throughout 2023.

Stage 2: Zoning

State and council-led zoning

In the March quarter, 3,000 lots were rezoned in NSW, with 20% of these in Greater Sydney and 80% in regional NSW. This included:

- 2,512 lots/dwellings from state-led rezoning approvals in Redfern North Eveleigh and North Tuncurry

- 488 lots/dwellings from 38 council-led rezoning approvals.

Since 1 July, 21,444 lots have been rezoned across NSW (43% of the interim target to June 2023).

An additional 55,000 lots are scheduled to be rezoned by June 2023, including in Canterbury-Bankstown, Randwick, Wollondilly and Campbelltown local government areas.

The department is closely monitoring scheduled rezonings that can contribute to the 2-year target of 100,000 lots rezoned by June 2024, and to provide a buffer to address the impact of rezonings that may not progress.

Stage 3: Infrastructure servicing

In March, $254 million in funding was announced and will be allocated to 36 projects (26 in Greater Sydney and 10 in regional NSW). Dwellings supported by these projects will be reported next quarter once funding agreements have been executed.

No other infrastructure funding agreements were executed by the Department this quarter.

Stage 4: Development approval

State and regionally significant approvals

In the March quarter, 2,620 dwellings were approved as part of a state or regionally significant development. Of these approvals, 2,515 (96%) were in Greater Sydney and 105 (4%) in regional NSW. This includes 391 dwellings for a build-to-rent residential development in Parramatta and 1,072 dwellings as part of a mixed-use development in Macquarie Park.

Since 1 July, 29,018 dwellings have been approved as part of a state or regionally significant development, with 87% in Greater Sydney and 13% in regional NSW. This exceeds the interim target for June 2023 by 79%.

Local development approvals

In addition, councils approved 17,459 dwellings as local development during the March quarter. Since 1 July, over 63,000 dwellings have been approved as part of a local development assessment. Approximately 66% of these dwellings are part of a multi-unit development.

Stage 5: Construction and completion

In regional NSW, 2,270 dwellings received construction approval during the March quarter. Since 1 July, 8,373 regional dwellings have received construction approval—66% of the interim target for 2022-23. Note this data reflects reporting from councils in the NSW Planning Portal and should not be compared to ABS data below which uses a different methodology.

Regional housing programs underway in NSW continue to support the long-term target of 127,000 dwellings over 10 years by fostering a sustainable pipeline of supply. However, slowing construction activity will mean the interim target for June 2023 will not be met.

ABS data on building approvals show construction approval was down 18% in the 12 months to March 2023 (49,478 dwellings) compared to the previous year. The decline for this period marks the lowest level of dwelling approvals in a decade. Currently multi-dwelling approvals make up 47% of total construction approvals, whereas at the peak in 2016 this was around 60%.

Residential building approvals have fallen since mid-2021, driven by multiple factors, including shortages of construction material and labour, rising interest rates, and falling housing prices.

Dwelling commencements were down 23% in the 12 months to December 2022 (48,538 dwellings) compared to the previous year. In addition, dwelling completions have fallen 7% in the 12 months to December 2022 (46,005 dwellings) compared to the previous year with further declines anticipated. As reported in Q2, the slowdown poses a significant risk to the pipeline of new dwellings.

Under the National Housing Accord, NSW has committed to contributing to the national aspirational target of delivering 1 million new ‘well-located’ homes between 2024 and 2029. Monitoring progress towards this target will require a greater focus on all stages of the housing supply pipeline through to dwelling completion, including expanded reporting and data collection to provide insights on performance.

Source: Australian Bureau of Statistics, Building Approvals, Australia (original) (data to March 2023)

Source: Australian Bureau of Statistics, Building Approvals, Australia (original) (data to December 2022)

Housing supply pipeline – key indicators summary

| Target | Q3 (Jan-Mar 2023) | YTD July 2022 to March 2023* | |

|---|---|---|---|

| Strategy Planning | Number of IDPs submitted to DPE | 3 | 32 |

| Zoning | Potential dwellings unlocked through rezonings | 3,000 | 21,444 |

| Infrastructure servicing | Potential dwellings supported by new NSW infrastructure programs | 0 | 43,738 |

| Approvals | Potential dwellings unlocked through approvals (state and regionally significant) | 2,620 | 29,018 |

| Potential dwellings unlocked through Local Development Applications | 17,459 | 63,397 | |

| Construction and completions | Number of dwellings with construction approval in regional NSW | 2,270 | 8,373 |

*YTD totals include Q1 and Q2 decisions applied retrospectively in the Planning Portal.